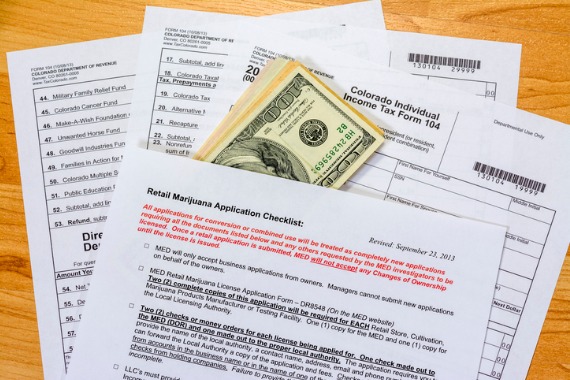

IRS Code 280E is a significant thorn in the sides of cannabis industry operators. While cannabis has been legalized in many states (and its federal legalization appears inevitable), it remains illegal on the national level.

Originally designed to keep illegal drug manufacturers and dealers from claiming operating expenses as deductions on tax returns, IRS Code 280E continues to force a burden on legitimate organizations that doesn’t apply to traditional businesses.

Because cannabis remains federally illegal, growers that focus on medical marijuana are essentially coupled with dealers of illicit drugs, and thus barred from claiming legal business expenses as deductions. This categorization results in a cannabis organization’s taxable income becoming exceedingly higher than it is for businesses in other industries.

Easing the burden

Since the advent of legal cannabis, talented accountants and business operators have nonetheless found ways around the tremendous burden 280E dumps upon the industry. While there is no magic way around Code 280E’s restrictions, there are a few ways to claim deductions that allow cannabis operators to remain compliant while also dropping their taxable income.

It is important to note that this post’s intention is not to suggest misclassifying business expenses in order to claim a deduction for them. In fact, the worst thing a legal cannabis operator can do is risk their entire business by getting overly creative with classifications to save money.

So, what is deductible, then?

Based on how the code is written, 280E affects the many categories of the cannabis industry differently. The law aims explicitly at “trafficking” operations, and thus offers ways around the limitations depending upon the classification of specific labor and production expenses.

For instance, cannabis manufacturers can often claim deductions for labor practices such as cleaning, trimming, packaging, and others, and can claim deductions for things like equipment maintenance costs.

Cannabis deductions, however, are almost always subject to some degree of interpretation due to how different operations function in their workflows — regrettably, no one-size-fits-all solution exists to decipher whether or not your expenses are deductible.

Figuring out deductions

You’ll ultimately need to work with an accountant (ideally one with cannabis industry expertise) to determine final deductions, and it is vital that you correctly and uber-diligently code all transactions within your organization.

Claiming deductions is about being able to show precisely how money was spent—what it was spent on, and what it wasn’t—to illustrate whether a deduction went toward “trafficking” activities.

Tracking all of your cannabis expenses and coding them correctly manually is both a time-intensive and extremely risky proposal. Aside from wasting time (and therefore money) hand-tracking numbers through spreadsheets, manual data entry is one of the most dangerous things a cannabis business can do because of the enormous potential for inevitability of human error.

Stodgy old Uncle Sam, who still believes everything he saw in “Reefer Madness,” doesn’t bother with determining if a misclassified deduction rooted in an honest mistake. Instead, the feds have been known to come down hard on cannabis companies as if they’re corrupting drug dealers trying to circumvent the law.

As such, one of the wisest decisions a cannabusiness can make is investing in industry-specific tracking, accounting, and compliance software.

The tremendous complexity of industry compliance is impossible to keep straight without modern technology, especially considering how often cannabis compliance regulations change. Cannabis accounting software turns the compliance challenge into an automated afterthought.

The right cannabis industry business software offers tools to help you easily and legally classify labor, material, and other expenses so you can be sure the deductions you claim are accurate.

Contact us to find out which of our cannabis accounting solutions is the right fit for you.